Planning for your child’s education can feel overwhelming, with a sea of financial options to navigate. Two popular contenders for the education savings crown are the 529 plan and the Roth IRA. Each has its own set of rules, benefits, and potential drawbacks, making the choice a little tricky.

This guide dives into the details of both, exploring how they work, their tax advantages, contribution limits, investment options, and the impact they have on financial aid. We’ll also look at flexibility, control, and estate planning implications to help you decide which path is best for your family’s future.

529 Plan vs. Roth IRA: The Best Way to Save for Your Child’s Education

Choosing the right savings vehicle for your child’s education can feel overwhelming. Two popular options, 529 plans and Roth IRAs, offer unique advantages. Understanding the mechanics, tax benefits, and limitations of each is crucial to making an informed decision. This guide will delve into both options, helping you navigate the complexities and choose the best path for your family’s financial future.

Understanding the Core Mechanics of a 529 Plan and its Tax Advantages

A 529 plan, named after Section 529 of the Internal Revenue Code, is a tax-advantaged savings plan designed to encourage saving for future education expenses. These plans are sponsored by states, state agencies, or educational institutions. They offer a straightforward way to accumulate funds for qualified education costs. Think of it as a specialized investment account dedicated to education.

The fundamental operational aspects of a 529 plan involve several key components. First, you, as the account owner, select a plan. Most states offer their own plans, and some also offer “advisor-sold” plans, which are typically managed by financial professionals. You then contribute to the plan, choosing from various investment options, which often include age-based portfolios that automatically adjust their asset allocation as your child gets closer to college age.

Contribution limits vary by state but are generally quite high, allowing for significant savings. The funds grow tax-deferred, meaning you don’t pay taxes on investment earnings as they accumulate. Finally, when your child is ready for college, you can use the funds to pay for qualified education expenses.

529 plans offer several significant tax advantages. Contributions to a 529 plan are typically made with after-tax dollars. However, the earnings grow tax-deferred, and withdrawals used for qualified education expenses are tax-free at the federal level. Many states also offer a state income tax deduction or credit for contributions to a 529 plan. This can provide an immediate tax benefit.

For example, some states allow you to deduct contributions up to a certain amount from your state taxable income. This can effectively lower your overall tax burden. Additionally, the beneficiary of the 529 plan (the child) does not pay taxes on the earnings when the funds are used for qualified education expenses.

Let’s consider an example scenario. The Smith family wants to save for their newborn daughter, Emily’s, college education. They decide to open a 529 plan in their state, which offers a state income tax deduction for contributions. Over the next ten years, they contribute $5,000 annually to the plan, totaling $50,000 in contributions. Assuming an average annual return of 7%, the investments grow significantly.

The earnings are not taxed during this period. After ten years, the account has grown to, let’s say, $70,000. When Emily is ready for college, the Smiths can withdraw the funds to pay for her tuition, fees, books, and room and board, all tax-free at the federal level. The state income tax deduction they received each year further reduces their overall tax liability.

This tax-advantaged growth and tax-free withdrawals make the 529 plan a powerful tool for college savings, offering substantial benefits over a decade.

Investigating the Nuances of a Roth IRA and its Potential for Educational Savings

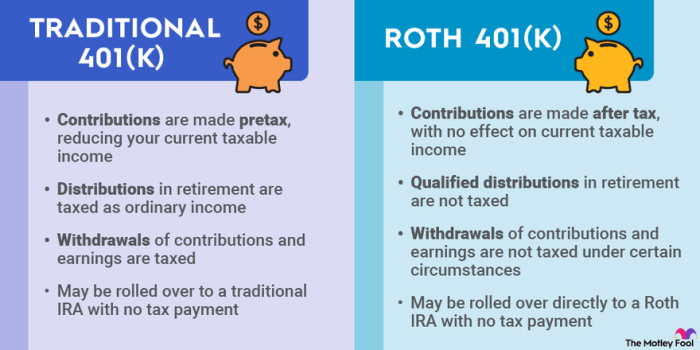

A Roth IRA, or Roth Individual Retirement Account, is a retirement savings plan that offers tax advantages. While primarily designed for retirement, it can also be used for other financial goals, including education. Understanding its mechanics is key to making an informed decision about using it for college savings.

The core functions of a Roth IRA revolve around contributions, eligibility, and withdrawals. You contribute after-tax dollars to a Roth IRA, and the earnings grow tax-free. However, there are contribution limits, which change periodically but are typically a few thousand dollars annually. Eligibility is based on your modified adjusted gross income (MAGI). If your income exceeds certain thresholds, you may not be able to contribute the full amount or at all.

The implications of early withdrawals for educational purposes are crucial. You can withdraw your contributions at any time, tax- and penalty-free. However, if you withdraw earnings before age 59 ½, you may be subject to taxes and a 10% penalty. There is an exception for qualified education expenses, which allows you to withdraw earnings tax-free, but not penalty-free.

Using a Roth IRA for educational savings offers several potential benefits. First, the earnings grow tax-free, just like in a 529 plan. Second, you can withdraw your contributions at any time, tax- and penalty-free. This provides a level of flexibility not always available with other savings vehicles. If your child doesn’t need the money for education, you can use it for retirement.

Here’s a summary of the benefits:

- Tax-Free Growth: Earnings accumulate without being taxed.

- Withdrawal of Contributions: You can withdraw your contributions at any time without penalty or taxes.

- Flexibility: Funds can be used for education or retirement.

Here’s a comparison chart that contrasts the key features of a Roth IRA and a 529 plan:

| Feature | 529 Plan | Roth IRA | Notes |

|---|---|---|---|

| Contribution Limits | High, varies by state (often exceeding $300,000 lifetime) | Annual limits (e.g., $6,500 in 2023, $7,000 for those 50+) | Roth IRA contribution limits are significantly lower. |

| Tax Implications | Tax-deferred growth, tax-free withdrawals for qualified education expenses | Tax-free growth, tax-free withdrawal of contributions, potential tax and penalty on early withdrawal of earnings (unless for qualified education expenses) | Both offer tax advantages, but Roth IRA has more complex withdrawal rules. |

| Investment Options | Age-based portfolios, static portfolios, individual fund choices | Stocks, bonds, mutual funds, ETFs | Roth IRA offers a broader range of investment choices. |

| Eligibility | Anyone can open a 529 plan for a beneficiary. | Income limits apply to contributions. | Roth IRA has income restrictions, while 529 plans do not. |

Comparing Contribution Limits and Flexibility in 529 Plans and Roth IRAs

Contribution limits play a significant role in determining how much you can save for education. Understanding the rules for both 529 plans and Roth IRAs is crucial for effective financial planning.

529 plans offer relatively high contribution limits. Both annual and lifetime limits exist, but they are generally generous. Annual contribution limits vary by state, but often exceed $300,000 or more. Some states may allow contributions up to the amount needed to cover five years of college expenses. Lifetime contribution limits are also high, often in the hundreds of thousands of dollars.

Exceeding these limits is rare, but if it happens, the plan may reject the excess contributions or require you to remove the excess funds and any earnings. It’s essential to check the specific rules of your state’s 529 plan. The high contribution limits make 529 plans attractive for those who want to save a significant amount for education over time.

Roth IRAs have different contribution limits. Annual contribution limits are set by the IRS and change periodically. In 2023, the contribution limit was $6,500, with an additional $1,000 catch-up contribution allowed for those age 50 or older. Eligibility is determined by your modified adjusted gross income (MAGI). If your MAGI exceeds certain thresholds, you may not be able to contribute the full amount or at all.

For example, in 2023, if your MAGI was over $153,000 (single) or $228,000 (married filing jointly), you couldn’t contribute to a Roth IRA. These income thresholds and their impact on contribution amounts are important factors to consider. The lower contribution limits of Roth IRAs mean that you may not be able to save as much for education as you could with a 529 plan, especially if you have a high income.

Here are different methods that could be used to contribute to either plan:

- Payroll Deduction: Many employers allow you to contribute to a 529 plan or Roth IRA directly from your paycheck. This simplifies the process and ensures regular contributions.

- Automatic Transfers: You can set up automatic transfers from your checking or savings account to either a 529 plan or Roth IRA. This is a convenient way to ensure you’re saving regularly.

- Lump-Sum Contributions: You can make a one-time contribution to either plan, such as when you receive a bonus or tax refund.

- Gifting: Grandparents, other relatives, or friends can contribute to a 529 plan. Under current gift tax rules, contributions up to $17,000 per year (as of 2023) per person are tax-free.

Examining the Investment Choices and Growth Potential of Each Savings Vehicle

The investment options available in a savings plan directly impact its growth potential. Understanding the choices within 529 plans and Roth IRAs is critical for making informed investment decisions.

529 plans offer a range of investment options, catering to different risk tolerances and investment strategies. Age-based portfolios are a popular choice. These portfolios automatically adjust their asset allocation over time, becoming more conservative as the beneficiary approaches college age. For example, a portfolio designed for a child entering college in 15 years might initially be heavily weighted towards stocks, with a higher risk tolerance.

As the child gets closer to college, the portfolio gradually shifts towards bonds and cash, reducing risk. Static portfolios offer a fixed asset allocation, such as a mix of stocks and bonds, that remains constant over time. Individual fund choices allow you to select specific mutual funds or other investments, giving you more control over your portfolio but also requiring more active management.

The investment choices within a 529 plan can significantly affect its growth potential. For instance, a portfolio with a higher allocation to stocks may offer greater potential for growth over the long term, but also carries higher risk. Conversely, a more conservative portfolio with a higher allocation to bonds may offer less growth potential but with lower risk.

Roth IRAs provide a wide variety of investment options, allowing for significant flexibility in portfolio construction. You can invest in stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other assets. The investment choices you make within a Roth IRA can dramatically affect its growth potential. For example, investing in a diversified portfolio of stocks and ETFs that track the S&P 500 can provide significant growth potential over the long term.

Bonds, on the other hand, typically offer more modest returns but with lower risk. The investment options available within a Roth IRA give you the opportunity to tailor your portfolio to your individual risk tolerance and financial goals. The flexibility to choose from a wide range of investments allows you to potentially maximize growth while managing risk. The growth potential of a Roth IRA depends heavily on the investment choices you make.

A well-diversified portfolio that aligns with your risk tolerance can offer substantial returns over time.

Here are the risks and rewards associated with different investment strategies:

- 529 Plans:

- Age-Based Portfolios:

- Risks: Market volatility can impact returns, especially in the years leading up to college. The automatic adjustments may not always align with your risk tolerance.

- Rewards: Convenience, diversification, and a generally suitable asset allocation for the time horizon.

- Static Portfolios:

- Risks: The asset allocation may become less appropriate over time as the beneficiary gets closer to college. Requires periodic rebalancing.

- Rewards: Allows you to maintain a consistent investment strategy, offering potentially higher returns than very conservative options.

- Individual Fund Choices:

- Risks: Requires more active management and the potential for poor investment decisions. Can lead to underperformance if not well-managed.

- Rewards: Greater control over investment choices, potentially higher returns if you select the right funds.

- Roth IRAs:

- Stocks:

- Risks: High volatility, especially in the short term. Market downturns can significantly impact your portfolio.

- Rewards: High growth potential over the long term. Historically, stocks have outperformed other asset classes.

- Bonds:

- Risks: Lower returns compared to stocks, interest rate risk.

- Rewards: Lower volatility and provide a more stable return.

- Mutual Funds/ETFs:

- Risks: Expense ratios can eat into returns. Market risk associated with the underlying assets.

- Rewards: Diversification, professional management, and access to a wide range of investment strategies.

Exploring the Impact of Financial Aid on Both 529 Plans and Roth IRAs

Financial aid is a crucial consideration for many families when planning for college. Understanding how assets in a 529 plan and Roth IRA are treated in the financial aid process can help you maximize your eligibility for grants and loans.

When determining eligibility for federal financial aid, assets held in a 529 plan are generally treated as the parent’s asset if the parent is the account owner. This means the assets are considered when calculating the Expected Family Contribution (EFC). The EFC is the amount the government believes a family can afford to pay for college. A higher EFC can reduce the amount of financial aid a family receives.

However, the impact of a 529 plan on the EFC is generally less severe than if the assets were held in the student’s name. The federal financial aid formula assesses parental assets at a lower rate than student assets. For example, parental assets are assessed at a maximum of 5.64% of their value. This means that for every dollar in a 529 plan owned by the parent, the EFC increases by a maximum of 5.64 cents.

This is a crucial distinction. It’s generally better to have college savings in the parent’s name rather than the child’s name, as it has a less significant impact on financial aid eligibility. It’s essential to understand that while a 529 plan may affect your financial aid, it can still be a valuable tool for saving for college. It’s also important to note that state-specific financial aid rules may vary.

Having a Roth IRA can also have implications when applying for financial aid. Roth IRAs are generally considered retirement assets and are not typically assessed when calculating the EFC. This is because retirement assets are often excluded from the financial aid calculation. However, the rules can be complex. The specific treatment of a Roth IRA may depend on the financial aid form you’re completing (e.g., FAFSA).

It’s important to understand that while Roth IRAs are generally not assessed, withdrawals from a Roth IRA for educational purposes could be considered income, which would then affect the EFC. The impact of a Roth IRA on financial aid eligibility is generally less significant than that of a 529 plan, but it’s important to be aware of the potential implications.

It’s advisable to consult with a financial aid advisor to fully understand how your Roth IRA might affect your specific financial aid situation. It’s crucial to understand how your assets are assessed to make informed decisions.

Here’s a visual representation of the impact of 529 plans and Roth IRAs on financial aid eligibility:

529 Plan Impact:

- Asset Ownership: Typically owned by the parent.

- Assessment Rate: Parental assets are assessed at a maximum rate of 5.64% for the EFC.

- Effect on EFC: Increases the EFC, but the impact is less severe than if the assets were in the student’s name.

Roth IRA Impact:

- Asset Type: Considered a retirement asset.

- Assessment: Generally excluded from the EFC calculation.

- Withdrawals: Withdrawals for educational purposes could be considered income, affecting the EFC.

Understanding the Rules for Qualified Withdrawals from a 529 Plan and a Roth IRA

Knowing the rules for qualified withdrawals is essential to avoid penalties and taxes. Both 529 plans and Roth IRAs have specific rules regarding how funds can be used for education.

The specific expenses that qualify for tax-free withdrawals from a 529 plan are defined by the IRS. These include tuition, fees, books, and room and board for eligible educational institutions. Eligible educational institutions include colleges, universities, vocational schools, and other post-secondary institutions that are eligible to participate in federal financial aid programs. There are limitations, however. For instance, the room and board expenses are only eligible if the student is enrolled at least half-time.

Also, the amount of room and board expenses that can be covered is limited to the school’s published cost of attendance. Furthermore, the IRS has expanded the definition of qualified expenses to include up to $10,000 per year for tuition at a K-12 private or religious school. This provides an added benefit for families who choose to send their children to private schools.

Withdrawals for non-qualified expenses are subject to both income tax on the earnings portion and a 10% penalty. Understanding these rules is essential to ensure that you use the funds appropriately and avoid any unexpected tax consequences. It’s also important to note that state rules may vary slightly, so it’s a good idea to check your state’s specific guidelines.

The rules for qualified withdrawals from a Roth IRA for educational purposes are also specific. You can withdraw your contributions at any time, tax- and penalty-free. This is a significant advantage. However, withdrawing earnings before age 59 ½ can have tax implications. Generally, the earnings portion of the withdrawal is subject to income tax and a 10% penalty.

However, there’s an exception for qualified education expenses. You can withdraw earnings tax-free, but not penalty-free, for these expenses. This means that while you won’t pay the 10% penalty, you will still have to pay income tax on the earnings portion of the withdrawal. This makes it crucial to track your contributions and earnings carefully. Qualified education expenses for Roth IRA withdrawals include tuition, fees, books, supplies, and equipment for higher education.

The expenses must be for the account owner, the account owner’s spouse, or the account owner’s child or grandchild. It’s essential to understand the tax implications of withdrawing earnings, even for qualified expenses. Always consult with a tax advisor to ensure you are following the rules correctly.

Here’s a flowchart demonstrating the process of determining whether a withdrawal is qualified:

Start

⇩

Is the withdrawal for educational expenses?

⇩

Yes ⇨ Is it a 529 plan or Roth IRA?

⇩

529 Plan:

⇨Is the expense qualified (tuition, fees, books, room & board)?

⇩

Yes ⇨ Tax-free withdrawal

⇩

No ⇨ Subject to income tax and 10% penalty on earnings

⇩

Roth IRA:

⇨ Is it a withdrawal of contributions or earnings?

⇩

Contributions ⇨ Tax-free and penalty-free withdrawal

⇩

Earnings ⇨ Tax-free, but potentially subject to income tax (no penalty)

⇩

No ⇨ Subject to income tax and 10% penalty on earnings

⇩

End

Assessing the Control and Flexibility Over Funds in 529 Plans and Roth IRAs

The level of control and flexibility you have over your savings can significantly impact your financial planning. Understanding these aspects for both 529 plans and Roth IRAs is important.

A parent or account owner has a high degree of control over a 529 plan. You can change the beneficiary of the plan to another family member, such as a sibling or cousin, if the original beneficiary doesn’t need the funds. This provides a valuable safety net. If your child receives a scholarship, you can withdraw the amount of the scholarship without penalty (though you’ll still pay taxes on the earnings).

You can also roll over the funds to another 529 plan for the same beneficiary or a different beneficiary. The portability of the plan is another key feature. The funds can generally be used at any accredited college or university in the United States, and some plans allow you to use the funds at foreign institutions as well. You have the flexibility to manage the investments within the plan, choosing from the available options.

However, you cannot use the funds for non-qualified expenses without incurring taxes and penalties. The level of control allows you to adapt to changing circumstances and ensure the funds are used for their intended purpose. You can generally manage the account online, making it easy to monitor your savings and make adjustments as needed. This flexibility and control make 529 plans a versatile tool for college savings.

A Roth IRA offers a different level of flexibility. You can withdraw your contributions at any time, tax- and penalty-free, for any reason. This provides a significant advantage. This can be particularly useful if you face unexpected expenses. However, withdrawing earnings before age 59 ½ can have tax implications.

You’ll generally have to pay income tax on the earnings portion, and you may also be subject to a 10% penalty, unless the withdrawal qualifies for an exception, such as for qualified education expenses. The flexibility of a Roth IRA extends beyond education. You can use the funds for retirement, a down payment on a home, or any other financial goal.

This flexibility makes a Roth IRA a versatile savings vehicle. While you have control over your investments, you must adhere to IRS rules regarding contributions and withdrawals. Understanding these rules is crucial to avoid any tax penalties. The Roth IRA offers flexibility in how you use the funds, providing options beyond education.

Here’s a side-by-side comparison of the control and flexibility features:

| Feature | 529 Plan | Roth IRA | Notes |

|---|---|---|---|

| Beneficiary Changes | Yes, to a family member | N/A | 529 plans offer beneficiary flexibility. |

| Portability | Can be used at any accredited college/university | N/A | 529 plans are portable for educational purposes. |

| Withdrawal of Contributions | N/A | Yes, at any time, tax- and penalty-free | Roth IRAs allow for flexible contribution withdrawals. |

| Withdrawal of Earnings | Taxed and penalized if not used for qualified education expenses | Subject to income tax and 10% penalty before age 59 1/2 (unless for qualified education expenses) | Both have restrictions on early earnings withdrawals. |

| Flexibility for Other Expenses | Limited to qualified education expenses | Can be used for retirement, a home down payment, or any other financial goal | Roth IRAs offer broader flexibility for fund usage. |

Evaluating the Estate Planning Implications of 529 Plans and Roth IRAs

Estate planning is a crucial part of financial planning. Understanding the estate planning implications of 529 plans and Roth IRAs is important to ensure your assets are handled according to your wishes.

529 plans have several estate planning considerations. The assets in a 529 plan are generally considered part of the account owner’s estate. This means that the plan is subject to the same estate planning rules as other assets. Upon the account owner’s death, the 529 plan assets are typically transferred to the named beneficiary. However, if the account owner dies and there’s no named successor, the assets become part of the owner’s estate and are subject to probate.

This can potentially delay the distribution of funds and may involve estate taxes. You can name a successor account owner to ensure a smooth transfer of the plan. You can also change the beneficiary to another family member. This is a crucial estate planning feature. The ability to transfer the plan to a new beneficiary provides flexibility and ensures the funds can still be used for education.

For example, if your child no longer needs the funds, you can transfer the plan to a grandchild or another family member. The estate planning implications of a 529 plan are relatively straightforward. The key is to name a successor account owner and a beneficiary to avoid probate and ensure the funds are used for their intended purpose. Consult with an estate planning attorney to ensure your 529 plan aligns with your overall estate plan.

Roth IRAs also have estate planning implications. Upon the owner’s death, the Roth IRA assets are typically transferred to the named beneficiary. The beneficiaries can be individuals, trusts, or other entities. The tax consequences for beneficiaries depend on the beneficiary’s relationship

Final Wrap-Up

Choosing between a 529 plan and a Roth IRA for education savings comes down to your individual circumstances, financial goals, and risk tolerance. Both offer unique advantages. The best choice depends on factors like your income, how much you want to save, and your long-term financial strategy. By carefully weighing the pros and cons, you can make an informed decision and set your child on the path to a brighter future.

Quick FAQs

Can I use both a 529 plan and a Roth IRA for education savings?

Yes, you can contribute to both, but be mindful of overall contribution limits. Coordinating both can maximize your savings potential, especially if you want to diversify your savings and take advantage of different tax benefits.

What happens if my child doesn’t go to college?

With a 529 plan, the funds can be used for other qualified education expenses, transferred to another family member, or withdrawn (subject to taxes and penalties on earnings). With a Roth IRA, you can withdraw your contributions at any time without penalty. Earnings, if used for non-qualified expenses, are subject to taxes and penalties.

Are there any fees associated with these accounts?

529 plans typically have administrative fees and investment management fees, which vary by plan. Roth IRAs often have fees associated with the investments you choose, like mutual funds or ETFs. It’s essential to compare fees when selecting a plan or financial institution.